Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

Hotel sector performance

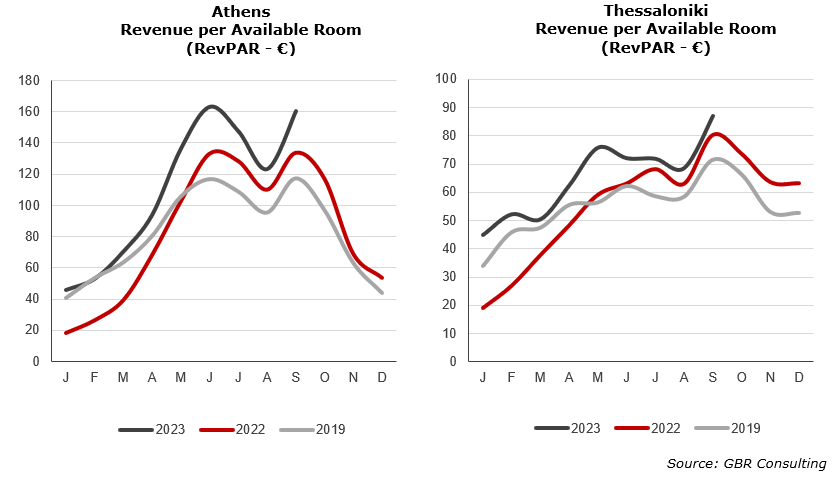

- The Athenian hotel sector registered a strong Q3 2023 with stable occupancy levels compared to Q3 2022 and slightly lower levels compared to Q3 2019, but with significant increases in ADR both compared to 2022 and 2019. Year-to-date September 2023/19 occupancy declined 2.4%, while room rates increased by nearly 31%. As a result, RevPAR improved 27.5% YTD September 2023 /19.

- Compared to Athens, hoteliers in Thessaloniki saw declining demand in 2023 compared to 2019 as occupancy levels decreased 4.3% YTD September 2023/19, while rooms rates increased by 25% for the same period. Compared to last year, occupancy improved, but only because the first months of 2022 showed very low occupancy levels. Comparing Q3 2023/22 occupancy was lower. Overall, RevPAR improved YTD September 2023 compared to both 2022 and 2019 by 24.0% and 19.5% respectively.

The surprise attack of militant Palestinian nationalist and Islamist movement Hamas on Israel by air, sea and land on October 7th was the start of a bloody conflict with thousands of casualties on both sides of the Israel-Gaza border. The Israel Defense Forces recently announced that 240 people have been taken hostage by Hamas.

For the city of Thessaloniki, the impact could be significant the coming period, as the Israeli market is by far the first international source market with 126,000 overnights in 2022 and 186,000 in 2019. Not all Israeli are traveling from Israel to Thessaloniki, but also from other countries. For Greece as a whole, the Israeli market represents a share of 1.3% in terms of overnights in 2022. The war, which is currently 3 weeks under way, might not end soon and could therefore also impact the real estate market as well. The UN general assembly has called for a ‘immediate, durable humanitarian truce’.

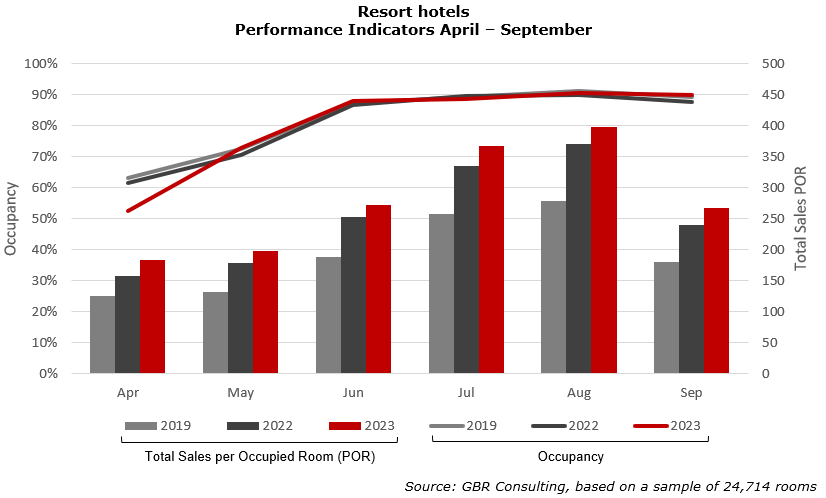

- The resort hotels in Greece achieved significant improvement of total revenues. A sample covering 24,714 resort hotel rooms, shows that total revenue during the period April – September increase by 14.0% for 2023/22 and 38.6% for 2023/19.

As shown in the graph below, this year’s season started in April with significantly lower occupancy levels than 2022 and 2019, but with much more rooms available. During the season occupancy stabilised at similar levels of 2022 and 2019. More specifically, occupancy for the period April – September declined 0.5% 2023/22 and 1.7% for 2023/19.

- The Total Sales per Occupied Room (POR) increased significantly throughout the reviewed period, resulting in an increase of 8.5% for 2023/22 and 44.2% for 2023/19.

2023 will be a record year for the Greek tourism sector

- Based on data up to August 2023 released by the Bank of Greece, international arrivals increased 18.4% 2023/22 and 3.7% 2023/19, while travel receipts without cruises increased by 14.4% and 10.5% respectively. 2023 will become a record year for Greek tourism exceeding the levels of 2019.

- Considering the performance up to August and that international arrivals at all international airports of Greece showed in bigger increase in September than August both compared to 2022 and 2019, it could be possible that travel receipts will reach € 20 billion this year including the cruise sector, after the € 18.2 billion registered in 2019, despite the unrest in the world in various regions and extreme conditions in some areas of Greece in terms of wildfires and floodings.

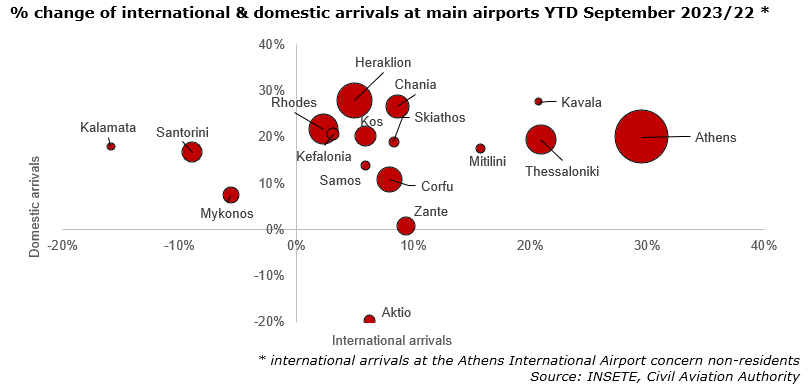

- The graph below shows the performance of Greece’s main international airports YTD September 2023/22 in terms of international and domestic arrivals.

- Athens, the largest international airport of Greece, outperformed other airports in Greece with an increase of 29.5% YTD Sep 2023/22 of international non-residents, while domestic arrivals increased 20.1%.

- Up to September 2023, the Civil Aviation Authority recorded 22.4 million international arrivals and 7.5 million domestic arrivals, representing a total increase of 13.7% for 2023/22 and 10.5% for 2023/19.

Main hotel transactions

- In October 2023, it was announced that HIG Capital acquired an incomplete hotel known as “the hotel of Chounta” from Eurobank. We understand that it concerns a deal of between € 22 - 23 million. The hotel is located in the area of Althea close to Lagonisi, at the Athens Riviera at a distance of 15 minutes from Athens airport. The hotel will be included in the portfolio of Ella Resorts.

- In August 2023, media reported that Reggeborgh Invest, acquired 75% of the 5-star hotel Corfu Palace from Christos Fokas for about € 30 million. The 5-star hotel which is located in Corfu town and features 106 rooms and suites, will be fully renovated while keeping its unique character.

- In July 2023, it was reported that Mare S.A., owned by Manolis and Nikos Varkarakis, acquired the 4-star hotel Sunshine Crete Village and the 5-star hotel Sunshine Crete Beach. The 2 hotels, with a total capacity of 330 rooms, are located in the area of Koutsounari in Ierapetra, Crete.

International hotel chains in Greece

- The presence of international hotel chains in Greece is on the rise. In our analysis we have categorised international chains that are part or related to tour operators and chains that are not. Major tour operators such as Tui have a presence in Greece with brands such as Club Lookea, Club Marmara, Club Magic Life etc. but also under the flag of Atlantica Hotels. Tui owns 50% of Atlantica Hellas SA. Der Touristik has a presence with brands such as Sentido, COOEE and Club Calimera. Currently, there are 90 hotels offering 20,360 rooms that are part of an international tour operator brand in Greece.

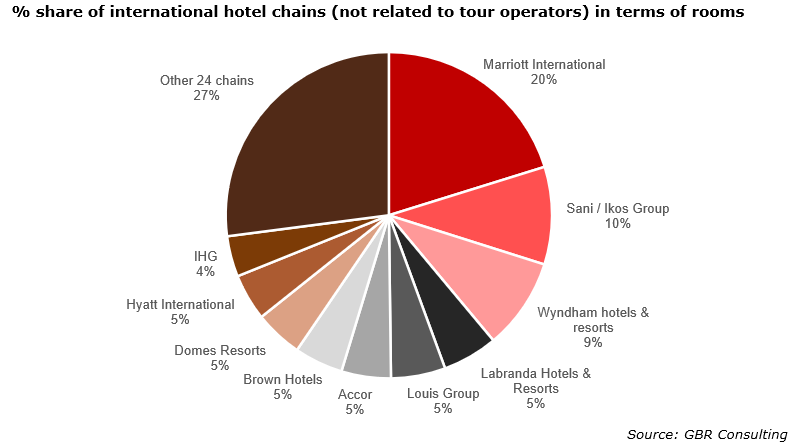

- In terms of international chains that are not tour operator related, we recorded 160 hotels with 26,540 rooms that are part of one of the 35 international chains that currently have a presence in Greece. These chains offer a total of 68 brands. 8 hotels are part of 2 international chains, offering 1,118 rooms.

- By way of comparison, in 2018, we recorded 89 hotels that were part of an international chain offering 14,869 rooms, so in 5 years an increase was achieved of 80% in terms of hotels and 78% in terms of rooms in this segment.

- In the 5-star category, 14% of the hotels and 18% of the hotel rooms are part of an international chain (not tour operator related), while in the 4-star category these percentages are 2% and 6% respectively. In the 3-star segment international chains currently do not have a presence, while in our view there are certainly opportunities.

- Marriott International is the market leader in Greece among the international hotel chains, noting that in 2014 they had no presence in the Greek market as late 2013 the contract with the Ledra Marriott in Athens (Grand Hyatt Athens today) was not renewed. From 2015 Marriott started building its presence in Greece and in that year Domes of Elounda announced that it would join the Autograph Collection, the first hotel of the collection in Greece and the Mediterranean.

In September 2016 Marriott International completed the acquisition of Starwood Hotels & Resorts, which had back then 1 Sheraton in Greece, 8 hotels part of The Luxury Collection including the Arion Astir Palace and 2 Westin Resorts including the Westin Athens Astir Palace. Today the Astir Palace operates as the Four Seasons Astir Palace.

With the acquisition of Starwood the company acquired also a majority stake in Design Hotels, while as from February 2021 Marriott fully owns design hotels. Back in 2017 Design Hotels had 12 members, while today 25 hotels are connected with over 1,600 rooms.

In May 2018 the company returned to Athens with the opening of the Athens Marriott, rebranded from the Metropolitan hotel. The first Moxy of the chain opened in Patra in the summer of 2019 under the name Moxy Patra Marina. Beginning 2022 the Moxy Athens City opened at Omonia Sq.

Finally, Marriott’s Autograph Collection (upper upscale) expanded in Greece after the Domes of Elounda in 2015 with the Domes Noruz in 2016, the Academia of Athens in 2019, the Domes of Corfu in 2021 and the Monasty in Thessaloniki in 2022 followed by the Domes Aulus Zante

- The map shows where hotels of international chains are located. Many of these hotels are located in established destinations such as Central Athens and Attica in general, Corfu, Mykonos, Santorini, Rhodes and Halkidiki.

- International hotel chains offer visibility, consistency & standardization, international sales & marketing networks, loyalty programs and access to know how in terms of design, operations, technology and human resources. Institutional investors partner with international brands to add value and to position their properties internationally. In the luxury segment, new customers could be attracted just because of the brand. Vice versa, international chains are looking for the right partners to roll out their brands.

- The Sani / Ikos Group is the first international luxury chain of Greek origin. Also Domes Resorts has become an international chain, which was founded in Greece. HIG Capital has launched through its local partner Inventio Ella Resorts and intends to expand internationally.

- Currently, there is a substantial pipeline of international chains that will enter the Greek market. The One & Only Aesthesis at the Athens Riviera will open this month. Another One & Only will open in Kea, while many others are planning including Banyan Tree, Six Senses, Rosewood (Blue Palace in Crete – just announced), Conrad and many others. Sense of place and Greek authenticity remain important aspects within the framework of sustainability.

|