Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

Athens & Thessaloniki

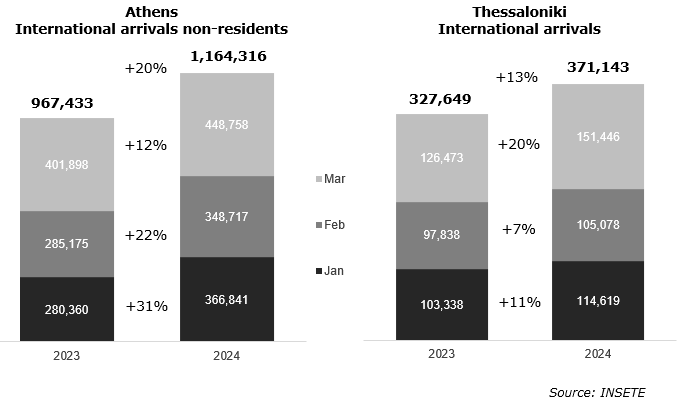

- During Q1 2024/23 international arrivals of non-residents at the Athens airport increased 20%, while the international arrivals at the airport of Thessaloniki increased 13%. Traffic registered growth across all months of the quarter.

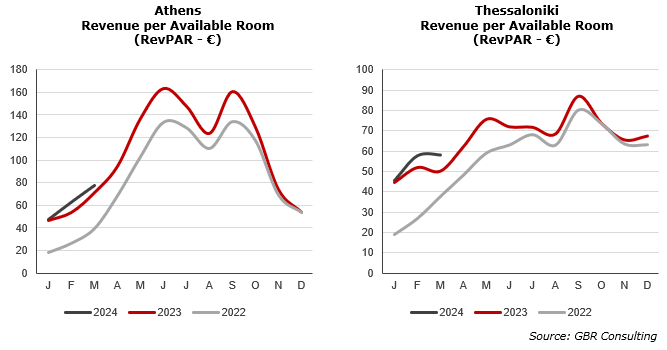

- In Athens, the rise in airport arrivals boosted occupancy rates by 5.9% in Q1 2024/23, accompanied by a 3.9% increase in room prices. Consequently, RevPAR improved by 10%.

- In Thessaloniki, occupancy did not improve, but due to the increase of ADR, RevPAR increased by 9.3% during Q1 2024/23.

- In this quarter the hotel associations of Attica – Athens and Thessaloniki presented their Guest Satisfaction and Hotel Performance reports in cooperation with GBR.

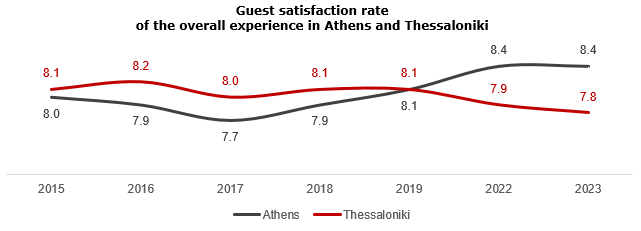

- Hotel guests in Athens remain very satisfied on their experience in the city with a stable mark of 8.4 out of 10, while in Thessaloniki satisfaction declined to 7.8 out of 10, marking its lowest level since 2015.

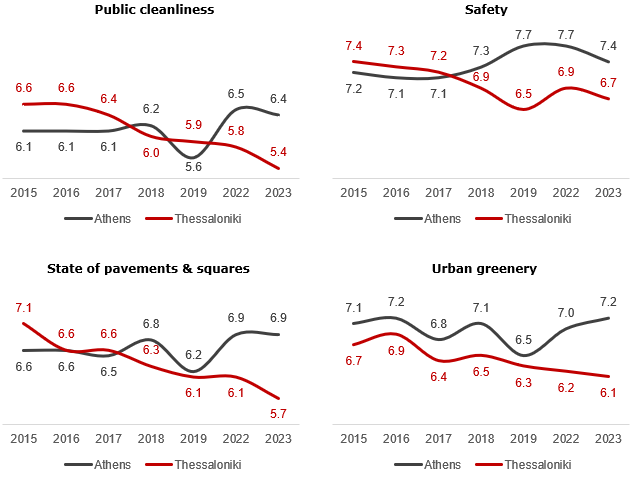

- The primary factors contributing to the decline in Thessaloniki's satisfaction ratings are the decreased rates in public cleanliness, safety, pavement and square conditions, and urban greenery.

- In Athens, specific areas in Central Athens are dealing with significant challenges regarding public cleanliness and safety, whereas in Thessaloniki, the issues are more widespread.

- It is noted that both in Athens and Thessaloniki new Mayors are in charge as from January 1st, 2024.

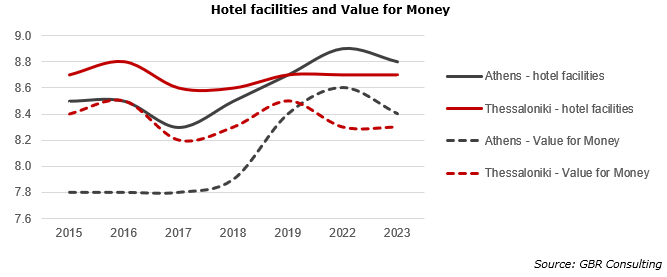

- The hotel facilities in both cities are highly appreciated. Value for Money recorded a decline in Athens from 8.6 in 2022 to 8.4 in 2023, likely impacted by the 12.8% increase in ADR during 2023/22. In Thessaloniki, room prices increased by 9.1% 2023/22 but maintained a stable Value for Money rating of 8.3 out of 10.

Next steps

- In 2023, Athens achieved a record tourism year, welcoming 7.1 million international non-resident arrivals and leaving tourists satisfied. Hotels are being upgraded, new concepts are introduced, local and national chains are expanding and international investors are attracted bringing often international hotel brands to the market.

- In that respect CBRE Research launched in April 2024 a report, the 2024 European Hotel Investor Intensions Survey, indicating that Athens has entered the top 10 of preferred city destinations as an increasingly appealing market for investors. This positions Athens as an emerging opportunity among key tourism cities, offering investors an alternative avenue for potential portfolio growth and diversification.

The research reveals that investor sentiment continues to favour London as the most attractive city for hotel investments. More surprising is that Madrid is now in second place with the city’s hotel dynamics proving increasingly attractive to global capital. Rome is ranked 4th and Barcelona 6th.

It's evident that Athens has emerged as a popular and appealing destination, with significant potential for further growth, especially considering that it has yet to reach the visitor numbers seen in cities like Rome and Barcelona.

However, to avoid facing challenges similar to those experienced in Barcelona, where residents are increasingly voicing concerns about the negative impacts of tourism on the city, Athens must prioritize sustainable growth through planning and management.

This entails strategies such as redistributing tourist traffic to lesser-known attractions and areas, alongside stricter regulations within the accommodation sector. Greek Tourism Minister Olga Kefalogianni has already placed the regulation of the Short-Term Rental sector on the agenda, aiming to introduce operational standards. Additionally, ongoing investments in infrastructure, safety, cleanliness, and green spaces are essential for enhancing the experience for both citizens and tourists.

- Thessaloniki is at a different stage of development, but could be at a turning point. A comparison between 2023 and 2019 reveals minimal progress:

- International arrivals at Thessaloniki International Airport increased by just 0.8%, while road arrivals at border points declined by 15% from 2019 to 2023;

- Overnight stays at hotels in Thessaloniki remained stable overall, with a 1% decrease for foreigners and a 1% increase for Greeks compared to 2019;

- The composition of international source markets has remained largely unchanged, especially compared to 2015, except for the loss of the Russian market and an increase in the share of American tourists;

- Hotel occupancy experienced a 4.2% decline from 2019 to 2023, while total hotel supply in the regional unit of Thessaloniki remained stable. In terms of hotel rooms, the 5 and 4-star segment saw significant growth over the past years, while the 3-star sector remained stable and the 1 and 2-star segments declined;

- ADR increased 25% 2023/19 in an environment of high inflation and increasing operating expenses. Despite this rise, Thessaloniki remains the city with the lowest ADR among 10 European peers in 2023;

- Guest satisfaction declined across most indicators, with only a few remaining stable and none showing improvement between 2015 and 2023;

- The Short-Term Rental market, which remains largely unregulated and affects local neighborhoods, has expanded to 3,600 units compared to the 4,800 hotel rooms in the municipality of Thessaloniki;

- The cruise sector has grown substantially, with cruise ship arrivals increasing from just 6 in 2019 to 68 in 2023, accommodating 4,865 and 60,900 cruise passengers, respectively. However, the objective is to establish Thessaloniki as a home port;

- Infrastructure development has lagged behind, with several key projects either not initiated, in the planning phase, or in progress. These include enhancements to road border crossings, airport access, the flyover project, the regeneration of the Thessaloniki International Trade Fair Exhibition, the seafront, and parking facilities.

- Conversely, with the successful completion of all major infrastructure projects, the operationalisation of the 13 metro stations by the end of 2024 and the implementation of projects addressing safety, cleanliness, quality of pavements & roads, greenery and parking by the municipality of Thessaloniki, the city could become truly attractive for its residents and its guests and could attract new markets and tourists with the support of a new marketing plan.

Main hotel transactions

- Attica Group announced in April 2024 that it acquired the 3-star Galaxy Hotel in Naxos offering 54 rooms for an amount of € 14 million through its subsidiary Attica Blue Hospitality. The hotel is situated next to the Naxos Resort Beach Hotel which was acquired in 2021 by the group for € 6.5 million.

- In February 2024 it was reported that two hotels have been acquired by a new hotel group formed through a partnership between the Papadakis family, owners of DTS Incoming Hellas, Sören Hartmann, president of the Federal Association of the German Tourism Industry, and Ferid Nasr, owner of luxury hotels across Europe, Egypt, and Tunisia. The group, known under the name G Hotel Collection, secured the 5-star Serita Beach Hotel in Crete with 276 rooms and the 5-star Roda Beach Resort & Spa in Corfu with 520 rooms for € 97 million. These properties were previously owned by the late Kostas Mitsis, who transferred ownership to his wife Eleni Lampri before his passing, who established the A Hotel chain. The resorts will be managed by the new team this season and renovated thereafter, aiming to enhance both properties.

- Following the acquisition of the 5-star Rhodes Bay Hotel & Spa (formerly the Amathus hotel) including Elite Suites Rhodes Bay in January 2024, totalling 357 rooms, H Hotels Collection (Hatzilazarou Group) announced in February 2024 the acquisition of the 4-star Titania hotel in Athens. Both properties were previously owned by London & Regional. The Titania hotel, located near Omonia Sq in the heart of Athens and featuring 385 rooms, was purchased by L+R for €50 million in July 2019, as reported by the press at that time.

- Finally, insurance company InterLife acquired the 4-star Elite hotel. The property is located in Rhodes town and offer 46 rooms and 2 suites. No transactions details were revealed.

|