Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

Performance H1 2023

- The first half of 2023 registered positive results for the tourism sector overall.

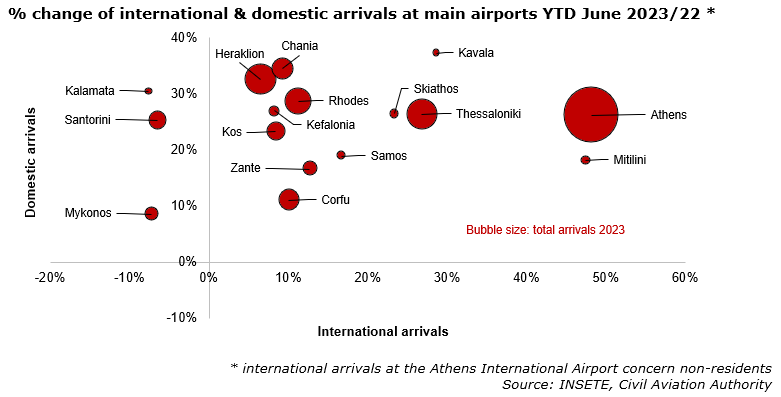

- Total international airport arrivals increased by 9.8% YTD June 2023 / 2022, while compared to 2019 a growth of 0.8% was recorded.

- At Greece’s main international airports, only the airports of Mykonos, Santorini and Kalamata showed a decline of international arrivals during H1 2023 / 2022 of 7%, 6% and 8% respectively, while at all main airports domestic traffic increased.

- On the other hand, international arrivals at the airport of Mykonos during H1 2023 were higher than the same period of 2019, while for Santorini these were significantly higher.

- Furthermore, domestic air traffic for the islands of Mykonos and Santorini is important as long haul passengers like Americans and other long haul markets are using these connections. The total traffic YTD June 2023/2022 at the Mykonos airport declined 1.3%, while at the Santorini airport total traffic increased by 7.8%. It must be noted that most tourists travel by ferry boat to Mykonos & Santorini.

- Market sources do indicate that both destinations are underperforming this year. Mykonos is dealing with overpricing, overcrowding, infrastructural problems and illegal constructions. Rich travellers seem to have chosen different luxury destinations this year within and outside Greece. The islands of Mykonos and Santorini also receive many day-visitors, who are staying at accommodation units on other islands. Also a massive number of cruise passengers are visiting the islands just for a few hours. All that being said, Santorini and Mykonos remain popular top destinations in Greece.

- The Athens airport outperformed with an increase of 48% YTD June 2023/22 of international non-resident travellers, while international arrivals at the Thessaloniki airport recorded an increase of 27%.

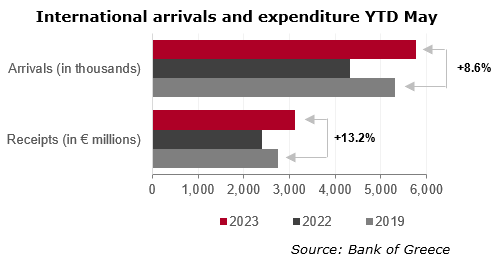

- The Bank of Greece reported nearly 5.8 million international arrivals during the period of January – May 2023, which represents an increase of 8.6% compared to the same period 2019.

- In terms of travel receipts € 3.1 billion was recorded, an increase of 13.2% compared to same period of 2019.

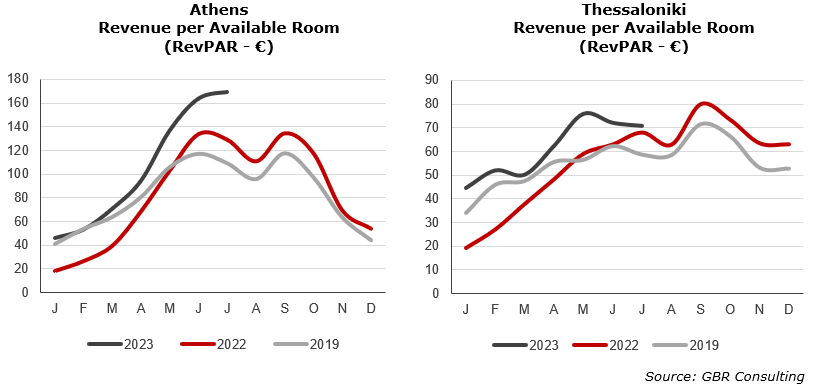

- The hotel sector of Athens registered during H1 2023 an increase of RevPAR of 45% compared to 2022 and 23% compared to 2019. Occupancy levels declined slightly compared to 2019, while room rates surged both in 2022 and 2023.

- In Thessaloniki similar trends are noted with an increase of RevPAR of 38.9% during H1 2023/22 and 18.7% during H1 2023/19.

- The resort hotels started the 2023 season later than 2019 as rooms available during March were considerably lower. In April more hotel rooms were available than 2022 and 2019 and as from May the season really kicked off.

- YTD June occupancy levels were stable with declines of 0.8% 2023/2022 and 1.6% 2023/2019, while total revenue per occupied room increased by 10.1% during H1 2023/22 and 46.9% during H1 2023/19.

- The island of Rhodes was during the first 6 months of 2023 one of the outperformers with the opening of fully renovated and rebranded units. Compared to 2019, international airport arrivals increased by 17.8% during H1 2023, which is reflected in improved occupancy levels and significant improvements of total revenue per occupied room. At July 18th, however, the island was hit by devastating wildfires (see below).

Main hotel transactions

- In June 2023, it was announced that Goldman Sachs Asset Management has acquired the Casa Cook and Cook's Club hotel brands from Fosun Tourism Group's FTC Hotels. The two lifestyle brands were previously part of the Thomas Cook Hotels & Resorts portfolio. After Thomas Cook collapsed in 2019, Chinese conglomerate Fosun bought the Thomas Cook brand. The two brands feature 16 franchised properties in the Mediterranean and Red Sea. In Greece there are 8 hotels operating under the two brands (3 Casa Cook hotels in Mykonos, Samos and Rhodes and 5 Cook’s Club hotels in Corfu, Rhodes and Crete).

- In May 2023, Everty, part of YNV Group, announced the acquisition of the 5-star hotel Elounda Gulf, located in the area of Elounda in Crete. Elounda Gulf Villas which is member of the Small Luxury Hotels of the World features 15 suites and 18 private villas. Elounda Gulf is Everty's third investment in the Greek hospitality market after the development of Petrothalassa Villas in Hermionida, Peloponnese and the acquisition of the Iconic Santorini hotel in Imerovigli, Santorini.

- Earlier this year it was reported that HIG Capital acquired the 4-star hotel Aldiana Club Kreta located in Agios Nikolaos, Crete. HIG's investment plan includes the renovation, construction and upgrade to a 5-star hotel with a capacity of 370 rooms with a total budget of € 50 million. HIG is aiming for a 6,000 room hotel portfolio in Greece, all operated under the Ella Resorts hospitality platform.

- Fattal Group acquired, through an auction, the 5-star Kandia’s Castle Resort & Thalasso. The 5-star 105-room hotel, located in Kandia, near Nafplio, is currently closed, but will - according to the company's website - re-open in 2024.

Wildfires in Greece 2020 - 2023

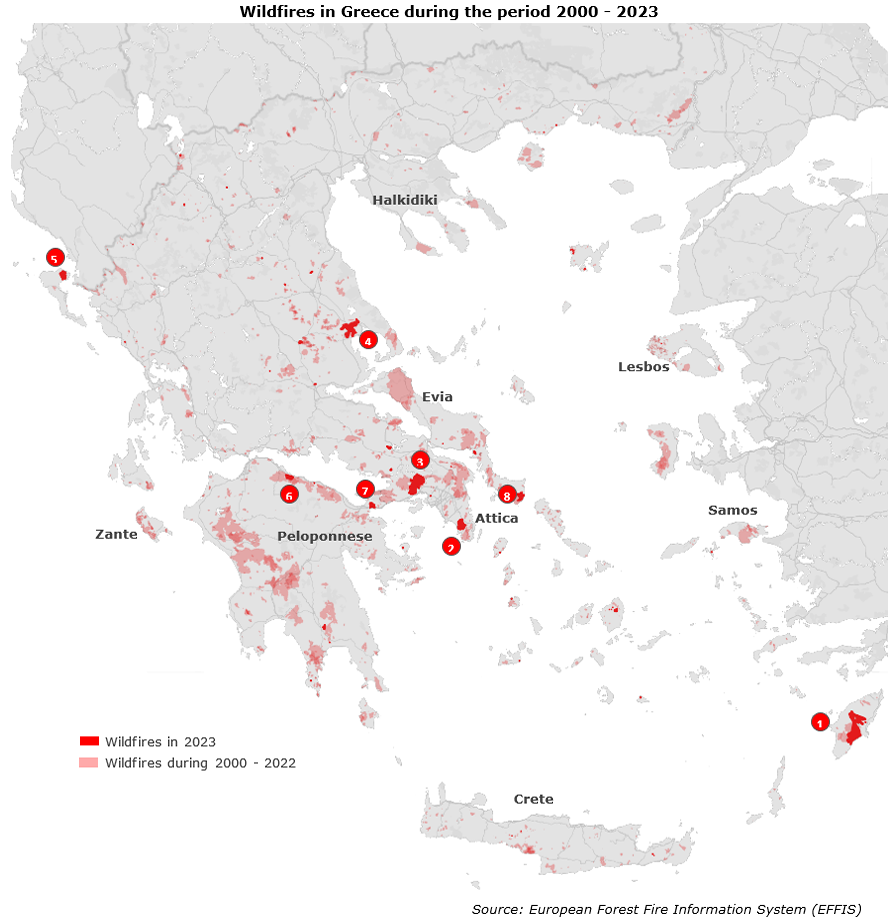

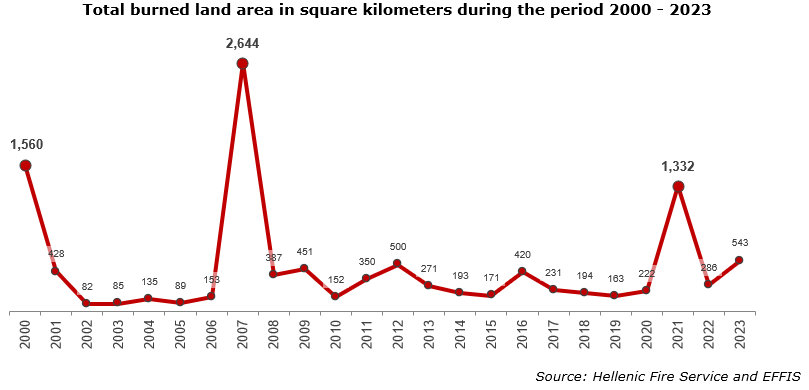

- During the period 2000 – 2023 a total of 11,000 square kilometers burned including areas which were hit multiple times.

- In terms of causalities the 2018 wildfires in Attica were the second-deadliest worldwide in the period 2000 - 2023 with 104 casualties as the fire in Pendeli rapidly expanded towards to the beach due to strong winds burning parts of Neos Voutzas, Mati and Kokkino Limanaki just north of the town of Rafina.

- In 2019, a trial version of the 112 message system was launched enabling authorities to send alert messages and instructions to mobile phones located in affected areas in case of an emergency (earthquakes, wildfires, floods, severe weather phenomena, COVID-19, dangerous gas leaks etc.). The system became fully operational in January 2020.

- In terms of burned land, the worst wildfire seasons during the past 13 years were recorded during the years 2000, 2007 and 2021 with loss of life and endangering human health and safety, destroying forests, farmland, wildlife, live-stock, infrastructure, buildings, recreational & tourism facilities and other elements:

- In 2000 a total of nearly 1,600 square kilometers burned. The wildfires on Samos destroyed a large part of the Aegean Island, while also the regional units of Korinthos, Fthiotida and Larissa were significantly affected.

- In 2007 an area of more than 2,600 square kilometers was destroyed due to wildfires in mainly western and southern Peloponnese as well as southern Evia. The summer of 2007 was hit by three consecutive heat waves of over 40 °C and severe drought. In total 84 people lost their lives because of the fires, including several fire fighters.

- The 2021 wildfires burned more than 1,300 square kilometers of forest and arable land mainly during the historic August heatwave with temperatures reaching 47.1 °C. The largest wildfires were in Attica, Olympia, Messenia, and the most destructive in northern Evia, where ferries had to evacuate about 2,000 people. In northern Evia alone about 500 square kilometers of wood land or nearly 14% of the island’s total surface area were burned. In total 3 people were killed.

- This year an area of 543 square kilometers has been destroyed so far with 117 square kilometers in Mandras, western Attica (item 3 on the map), 39 square kilometers eastern Attica, near Neos Kouvaras (item 2 on the map), 87 square kilometers near Volos, where also a military base was affected (item 4 on the map), 23 square kilometers northern Corfu (item 5 on the map), nearly 17 square kilometers northern Peloponnese near Aigio (item 6 on the map), 13 square kilometers in the area of Loutraki (item 7 on the map) and 21 square kilometers southern Evia near Karystos, where a firefighting plane crashed killing 2 young pilots (item 8 on the map).

- In Rhodes (number 1 on the map) 203 square kilometers burned, severely impacting local communities and the tourism sector.

Rhodes wildfires

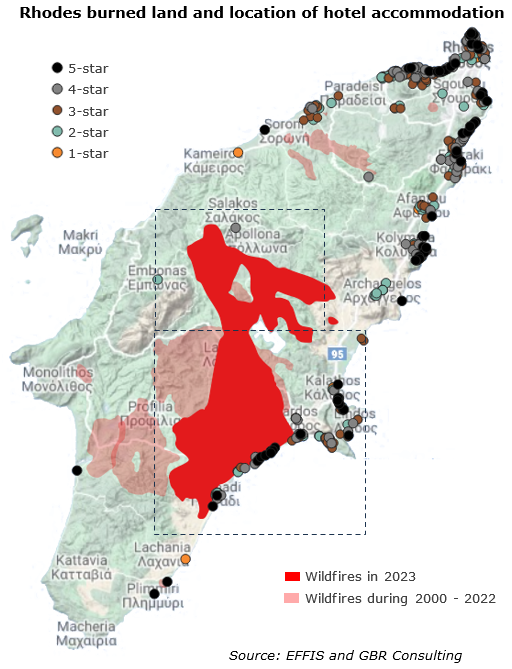

- Rhodes was hit by a devasting wildfire, which ravaged the island for 10 days from 18 – 27 July 2023 destroying an area of 14.5% of the total surface of the island.

- The villages of Kiotari, Plimmiri, Lardos, Lindos, Pefki and Vlicha were severely affected forcing thousands of people to evacuate in Greece’s biggest ever evacuation operation, while strong, changing winds complicated firefighting operations. A total of about 19,000 people, mostly tourists, were transferred to safety of which 16,000 by land and about 3,000 by sea. Pictures of fleeing holiday makers spread around the world. Evacuees were housed in other hotels, conference centers, indoor stadiums, schools and gyms. Local communities stepped up in providing food and drinks, sleeping facilities and in some cases even opened up their own homes.

- In the summer of 2008 the same area was hit by wildfires (see map below).

- Analysis of GBR Consulting shows that 84 hotels offering about 9,500 hotel rooms were affected by the wildfires in Rhodes indicated on the map by the dotted line.

- This represents 16% of the total hotels and 19% of the total hotel room capacity on the island of Rhodes.

- It also means that 84% of the hotels and 81% of the hotel rooms were not directly affected. The map shows big clusters of hotels are located on the north east and west side of Rhodes, where also the international airport is located.

- The number of flights at the airport declined significantly as operators had to cancel their flights.

- At this moment there is no fire on the island and hoteliers are working around the clock to re-open their properties and welcome guests again.

- The wildfires have caused much suffering for the local community and some have lost everything. Today Rhodes is a safe destination.

What next

- In a country where according to the World Tourism & Travel Council (WTTC) 20.7% (2019) and 18.5% (2022) of GDP is generated by the tourism sector, protection of its stunning natural environment should have the highest priority by developing and implementing a plan in terms of

- prevention: fire breaks and fuel management, public education & awareness, enforcing fire safety regulation, risk assessments and mapping, research & technology

- detection: wildfire detection technologies such as satellite remote sensing, drones, artificial intelligence, IoT based sensor networks, information sharing platforms etc.

- response: investing in firefighting resources for immediate response, effective evacuation plans & routes including shelters, transportation means, communication channels, emergency supplies etc.

- Climate change is not an excuse to not develop an integrated fire management strategy. Addressing climate change and its impacts is crucial in mitigating the risk of wildfires. A report of the UN Environmental Programme (UNEP) of last year mentioned that climate change and land-use changes will make wildfires more frequent and intense with a global increase of extreme wildfires of up to 14% by 2030, 30% by 2050 and 50% by the end of the century. The report states that Governments are not prepared and calls for a radical change in government spending on wildfires, shifting their investments from reaction and response to prevention and preparedness.

|